Shaking up the German Energy market – the Eon and RWE deal

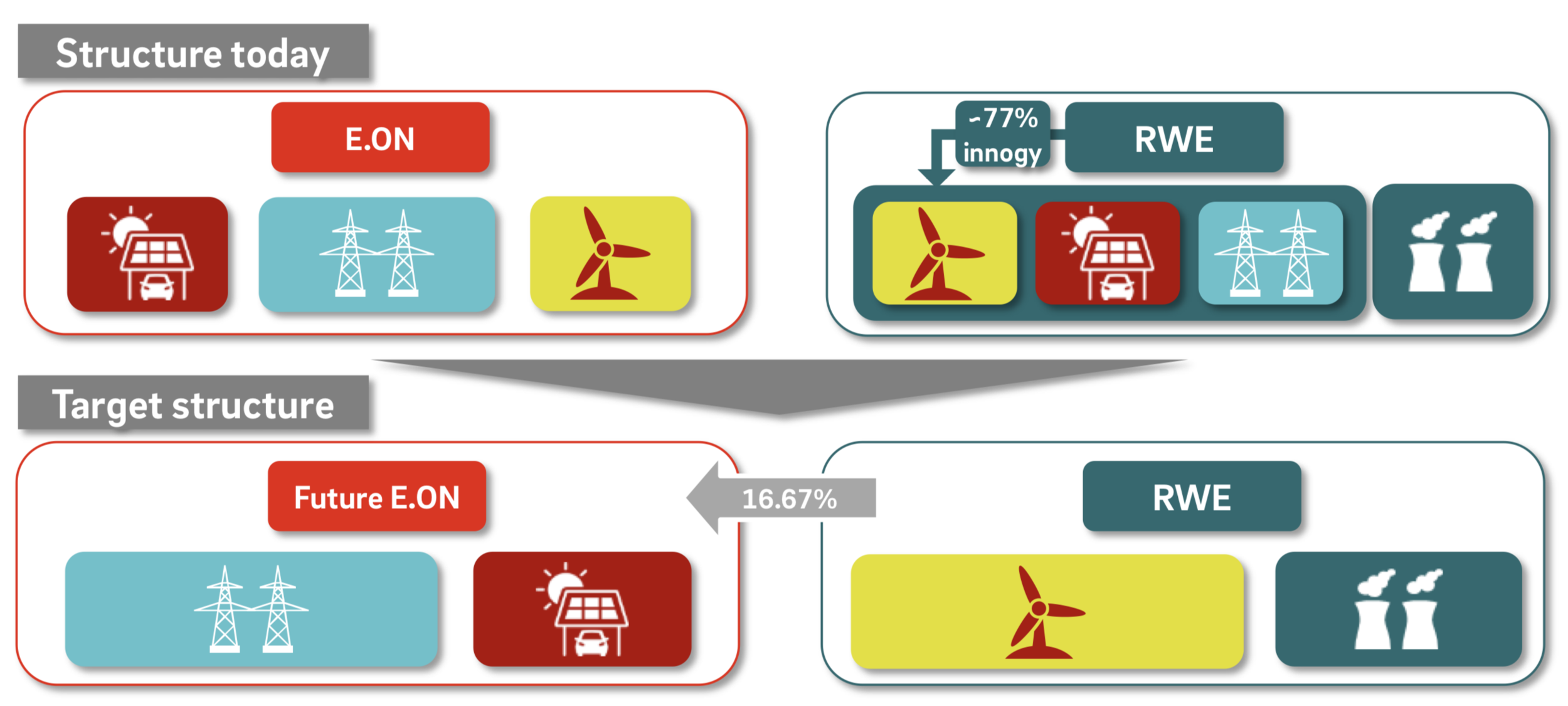

Since 2016, the largest German utilities, which happen to be major international players in the European energy market as well, have been in a strategic transition period. What happened in 2016 is that Eon and RWE separated their conventional generation business from network, retail and renewable business units. For RWE, innogy became responsible for renewable generation, distribution networks and the retail business. RWE itself, on the other hand, focused its business on conventional generation.

In the case of E.on, the new subsidiary Uniper assumed the task of conventional generation, while E.on itself operated the distribution grids, the renewable generation business and retail solutions. In this post here, we analyzed in greater detail the different drivers for this strategic shift in 2016. Most prominently, the separation of renewable and conventional generation seems reasonable because an investment in renewable generation cannibalizes revenues from conventional generation via reduced operation hours and lower prices at the spot market. This threat of self-cannibalization makes it difficult to develop a renewable generation portfolio within a company that depends on revenues from conventional generation. In this post we discussed the potential disruptive nature of renewable generation for conventional generation business.

The Changes in 2018

On 12th March 2018 both companies, E.on and RWE, made public that they will exchange resources to form two more focused companies. E.on will sell its renewable generation business to RWE and will in exchange receive the network and retail business from Innogy.

Figure 1: The new structure of E.on and RWE (E.on 2018)

The details of the proposed deal between E.on and RWE is specified in figure 2.

Figure 2: An overview of the asset exchange between E.on and RWE (E.on 2018)

The Future E.on – focus on regulated income and innovation in the retail business

For E.on, selling its renewable generation assets will result in a stronger focus on regulated incomes from network operation. Today, E.on’s EBIT is based by 65% on regulated earnings, mainly from the networks and partly from renewable generation. The new E.on will increase its Regulated Asset Base from 23 €Billion in 2017 to 37 €billion, which equals an increase of 62%. With the networks from Innogy, the new E.on will potentially derive 80% of its EBIT from regulated earnings. At the same time, the customer base will increase from 31 million to 50 million customers, again an increase of 62%. Figure 3 shows how the new E.on relates to other major players in the European energy market.

Figure 3: The European markets position of the new E.on (E.on 2018)

Several reasons come to mind why E.on chooses to focus on the regulated business in combination with the consumer segment. From our point of view, this strategy primarily aims at risk reduction. While renewable generation is a regulated business, this is likely to change in most European markets soon. Even today, due to decreasing subsidies and increasing competition, revenues from renewable generation are falling. At the same time, competition in the consumer segment is increasing. With digitalization, it is likely that competition in existing and new markets (like smart homes) will intensify soon. Reducing the risk by focusing on one of the competitive segments (renewables or retail) might therefore be a reasonable response.

In the consumer segment, both E.on and Innogy have concentrated on similar markets, which offers the potential for synergies. Furthermore, E.on and Innogy have invested money in the development of new innovation processes (e.g. both make use of innovation hubs and accelerator programs) that aim at developing new digital business models for the utilities. While this is a rather new business area for energy utilities, E.on and Innogy share the vision that digital consumer solutions rather than generation should become the focus of energy utilities in the future.

RWE – an even bigger dinosaur?

In contrast to E.on, RWE specializes in non-regulated earnings from conventional and renewable generation (which will become non-regulated earnings in the near future). The new RWE will become an even larger player in the conventional generation business than it is already today, by gaining E.on’s shares in nuclear and gas power plants. Today, RWE receives roughly 65% of its total earnings from generation. This share will increase to 90% after the deal with E.on has been closed. In addition, RWE will gain all renewable generation capacities from E.on. Together, the new RWE will then own 8 GW of renewable capacity in total. Thereby, RWE will operate the second largest renewable generation portfolio in Europe. Still, compared to the conventional generation of 46 GW renewables will play a minor role at RWE. The interesting question will be how RWE will deal with the risk of self-cannibalization: Investing in renewables results in decreasing earnings from conventional generation. So far, the experience from the last decade tells us that RWE will rather focus on conventional generation than actively shape the energy transition.

The potential implications for energy markets in Germany

In general, the deal will lead to a concentration of power in the different segments of the energy market. That’s why, it is currently not clear whether the competition regulation will approve of the plans of E.on and RWE. But if it does, RWE will gain significant market power in the generation business, while E.on will be very dominant in the consumer and network segment. While the network segment is regulated, the consumer segment is not. Therefore, the regulatory authorities might oppose to the proposed restructuring of the two energy giants.

If the deal is closed, E.on will gain a powerful position, especially when it comes to the development of new consumer services. Whether these new services are data-driven or not, to sell products it is always a competitive advantage to have an established connection with existing consumers. Especially in the context of energy consumption, most private households have not made much use of competition so far. In the case of electricity contracts, the switching rates in Germany and other European countries are rather small. Therefore, once a utility has won a customer, it is quite unlikely that he switches to another competitor. Though this might (hopefully) change in the future with more digital products entering the energy realm, it puts E.on in a better starting position compared to its competitors.

The potential implications for the energy transition

First of all, we need to take into consideration that the large utilities are only minor players in the energy transition. All utilities together own less than 15% of total renewable capacity in Germany. Still, in this segment, RWE would gain a significant role after the restructuring. Then, RWE would be the largest utility investor in renewables in Germany, especially in on- and offshore wind. Still, the investment of RWE alone, which is relatively small compared to the total investment by all parties (especially private households), will not determine how the energy transition evolves. However, after the restructuring, RWE will own even larger shares of conventional generation in Germany, which gives this company higher market power and political weight in discussing the future of energy production in Germany. Whether the government will listing to RWE’s positions remains to be seen. But it seems certain that RWE’s position to influence politics related to the energy transition might increase after the deal.

On the other hand, the energy transition strives to develop an energy system based on decentralized generation and distributed flexibility. Especially the latter requires new solutions and services that unlock the flexibility potential of all user groups: industrial, commercial and residential. Here, the fusion of Innogy and E.on might lead to more innovative solutions that support the energy transition on the consumption side, but only if E.on implements innovation processes and builds up cooperation with other innovators to develop successful services and products in the retail realm. This is questionable as consumer-centric innovation has not emerged as a strength of German utilities so far. In addition, the new E.on is certainly not smaller and hence less likely to adapt fast to changing environments.

E.on and RWE push for centralization to cope with the ongoing decentralization

It seems clear that both, E.on and RWE, strive for market power to address the challenges from increasing competition and decentralization. Whether this strategy will be successful remains to be seen. For those of us who favor the benefits of decentralization (higher shares of renewables, less market power, product differentiation, resilience etc.) the centralization targeted by E.on and RWE might be a step in the wrong direction. In our opinion, it is less important how RWE proceeds with the generation business since this business model is focused on conventional generation which does not offer any solutions for the overall challenges from climate change. More importantly, we should observe how E.on uses its market power: Will it evolve into an innovation engine for the energy transition or will it impose market entry barriers for those innovators that strive to make the decentralized energy transition a success?

Are distribution network operators in Europe threatened by a potential application of blockchain technology in the energy sector? This seems to be the pressing question that was at least partially the motivation for a recent report on blockchain in the energy sector by eurelectric, which is the European association of the distribution grid operators. From our perspective, this report reads like an attempt by the industry to reassure itself that its core business model – asset ownership and operation of the electricity networks – is not threatened by blockchain. While this might be true for asset ownership, this is different in the case of network operation.